Photovoltaic raw materials latest market

Silicon material

Silicon prices are expected to turn negative starting in March, with a monthly decline of about 3.2 percent. Single crystal recharging RMB price dropped from RMB235/KG to RMB225/KG, down by 4.26%; RMB price of single crystal compact material is maintained at RMB220/KG.

Last week, the average transaction price of domestic single crystal recharging was 228,000 yuan/ton, and the average transaction price of single crystal compact material was 226,100 yuan/ton, with a weekly drop of 4.8%.

It was the second cut since the rally and a sign of loose supply this year.

It is expected that the polysilicon price in the first quarter of this year will be maintained at about 220,000 yuan/ton. From the second quarter, nearly 500,000 tons of production capacity will be put into intensive production. Combined with the disappearance of winter heating energy demand, the fading influence of the Russia-Ukraine conflict, the reduction of high demand for photovoltaic modules and other reasons, the polysilicon price will enter a rapid decline stage, and it is expected to reach within 180,000 to 200,000 yuan/ton by the end of the third quarter.

Experts forecast that China's silicon production capacity will reach 2.404 million tons in 2023, up 99.8% year on year, with sufficient supply of production capacity and strong certainty of price decline. There is no doubt that in 2023, the tight supply situation of polysilicon will no longer return, and the downward trend of prices is very clear.

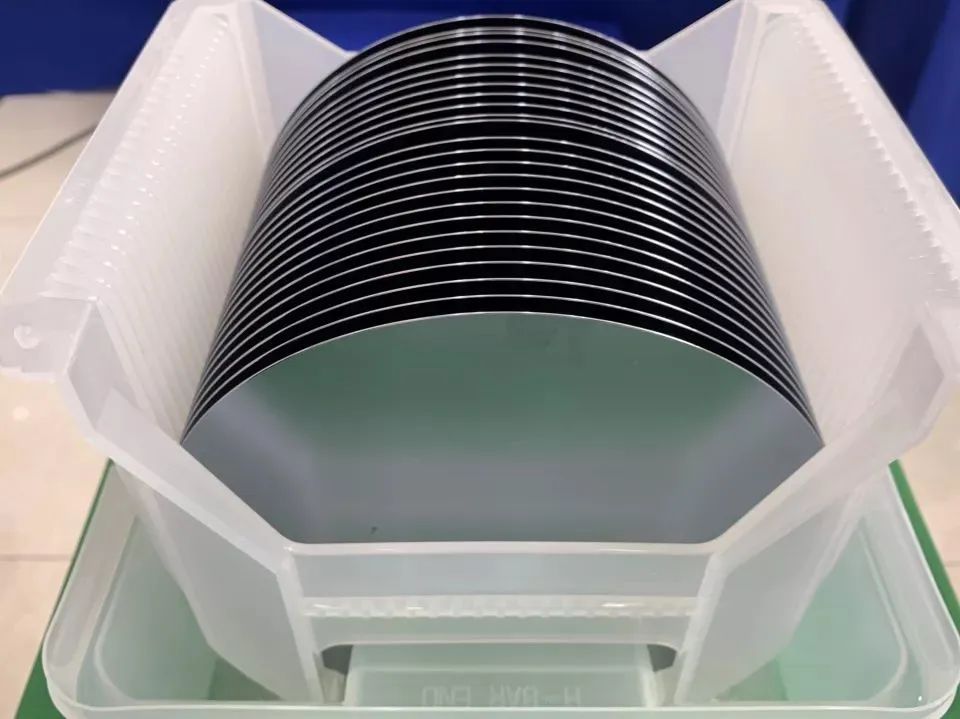

In late February, the tight supply and demand of silicon wafer market began to ease, and the price of silicon wafer continued to rise.

At the same time, the price of silicon wafers will be reversed after this brief rise, as a large amount of new wafer capacity will be released this year.

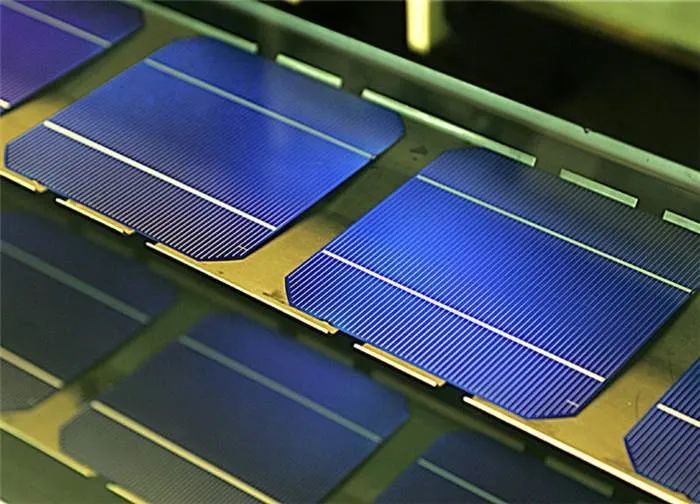

In terms of batteries, the leading factory significantly raised the price of batteries after February, driving the entire battery price back to 1.1 RMB per watt. This is mainly due to the increase in battery cost caused by the rebound of upstream silicon material price, coupled with the periodic shortage of silicon wafers and other factors, which affected the supply and demand of battery wafers. However, the market generally had certain expectations for the battery price increase this time. Therefore, the acceptability is high.

Solar Cell Type

M10 monocrystalline silicon wafer RMB quotation is RMB6.22/Pc; The quotation of USD is $0.792/Pc, which is reduced by -1.86% compared with before.

The latest quotation of G12 monocrystalline silicon wafer is RMB8.2/Pc; The USD quote fell 1.97% from $1.065/Pc to $1.044/Pc.

In terms of photovoltaic modules, with the price of upstream raw materials falling, the price of photovoltaic modules will return to the normal range simultaneously, which will effectively stimulate the release of terminal installed demand. The peak season of demand is expected to come earlier than in previous years. Therefore, photovoltaic module manufacturers are generally optimistic about the market in March and beyond, but the sharp fluctuations in the price of China's photovoltaic industry chain in the short term. As well as the policy impact of overseas key markets, the development trend of the photovoltaic market this year is still uncertain.

With the fall of upstream raw material prices, PV module prices will return to normal range simultaneously, which will effectively stimulate the release of terminal installed demand. The peak season of demand is expected to come earlier than in previous years. Therefore, PV module manufacturers are generally optimistic about the market in March and beyond. The trend of PV market development this year is still uncertain.

The retained profits of photovoltaic modules will also return to the normal range at the same time, which will effectively stimulate the release of terminal installed demand. The peak season of demand is expected to come earlier than in previous years, so the photovoltaic module manufacturers are generally optimistic about the market in March and after.

EVA resin

EVA particle prices rose this week, up 2.7%. Oil prices rose for the fifth day in a row as optimism about China's economic growth and demand continued.

EVA prices rose in a narrow range, and the market transaction shifted up. Terminal demand more cautious, just need to cover positions. Next week, the market supply and demand fundamentals change little, EVA prices are expected to be mainly high.

Backboard PET prices rose 2.3% this week. China's growth target of around 5 per cent will provide support for the global economy, and the fall in the dollar index underpinned the mood in the US and European oil futures markets. The operating load of polyester industry stabilized to 81.36%, the spot price of PTA rose, the spot price of ethylene glycol fell, and the production and sales of polyester market improved.

Recently, the overall trading of the domestic photovoltaic glass market is stable, the mainstream price is stable, and some transactions are available for discussion. The latest price of 2.0mm coated photovoltaic panel glass is RMB18.5/㎡; 3.2mm coated photovoltaic panel glass RMB latest offer is RMB25.5/㎡.