The market scale of monocrystalline silicon continues to expand, with photovoltaic as the main application field

The market scale of monocrystalline silicon continues to expand, with photovoltaic as the main application field.

Benefiting from the continuous breakthrough in production technology of local enterprises, the localization process of polysilicon in China has been accelerated.

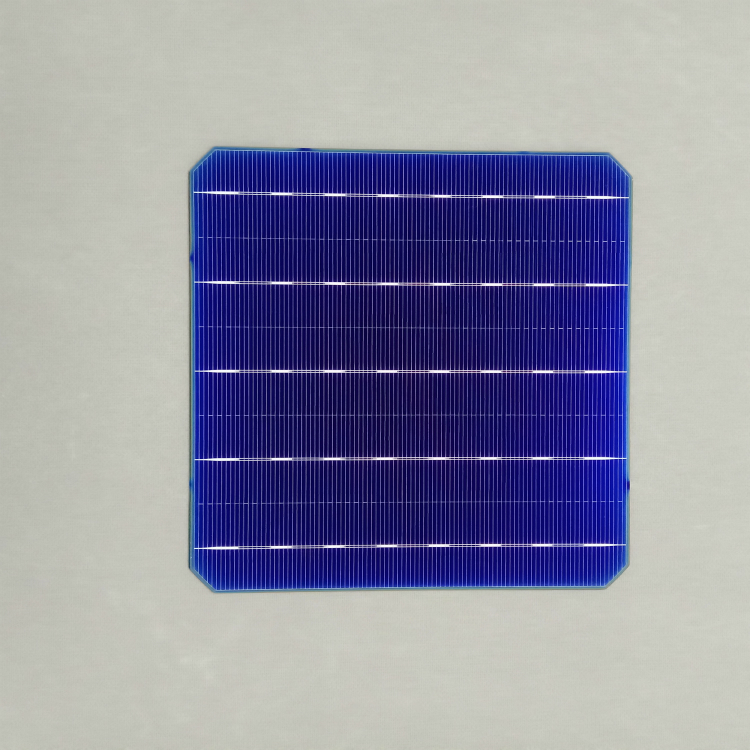

Monocrystalline silicon refers to the substance formed by silicon atoms in an arrangement, which is a relatively active non-metallic element crystal. Compared with polycrystalline silicon, monocrystalline silicon has the advantages of high photoelectric conversion efficiency, high mechanical strength, long service life, low fragmentation rate, and is widely used in photovoltaic power generation and semiconductor manufacturing.

Single crystal silicon production process includes crucible free floating zone melting method and crucible czochralski method. The crucible free floating zone melting method refers to the process of producing a melting zone at the contact of single crystal seed crystal and polycrystalline silicon rod by using high-frequency coils in a vacuum furnace chamber, and finally producing high-purity and small diameter single crystal silicon. Crucible Czochralski method is also known as Cheklauski method. In this method, the raw material polysilicon needs to be cleaned first to remove the impurities on its surface, and then the seed crystal is clamped on the pull rod fixture. After crystal introduction, shoulder setting, equal diameter growth, finishing and other processes, monocrystalline silicon is finally produced.

Monocrystalline silicon takes polycrystalline silicon as the main raw material. According to the statistics of China Photovoltaic Industry Association, the output of polycrystalline silicon in China will reach 505000 tons in 2021, with a year-on-year growth of 28.8%. Benefiting from the continuous breakthrough in production technology of local enterprises, the localization process of polysilicon in China has been accelerated. At present, China's polysilicon output can fully meet the production demand of monocrystalline silicon. In 2021, China's monocrystalline silicon output will reach 153.6GW, with a year-on-year growth of 24.6%. With the continuous acceleration of the capacity distribution process of local enterprises, it is estimated that by 2025, China's monocrystalline silicon output will exceed 370.0GW.

According to the 2022-2027 Market Research Report on China's Monocrystalline Silicon Industry released by New Horizon Industry Research Center, monocrystalline silicon is mainly used in the photovoltaic field, with solar cells as its largest demand end. According to the data of the National Bureau of Statistics, from January to June 2022, the cumulative output of solar cells in China will reach 142.0GW, with a cumulative growth of 31.8%. Benefiting from the rapid development of downstream industries, the scale of China's monocrystalline silicon market continues to expand. In 2021, the scale of China's monocrystalline silicon market will reach 46.32 billion yuan, with a year-on-year growth of 24.6%. With the support of national policies, the prosperity of China's photovoltaic industry continues to improve, which will bring broad market space for monocrystalline silicon.

China's monocrystalline silicon market is highly competitive and the industry concentration is high. Longji Green Energy, Jinke Energy, Jingao Solar, Zhonghuan Semiconductor and Jingyuntong Technology are the leading single crystal silicon enterprises in China, among which Longji Green Energy occupies nearly 40.0% of the market. Longji Lvneng is the world's largest single crystal silicon wafer manufacturer. According to the company's annual report, in 2021, Longji Lvneng's single crystal silicon wafer shipment will reach 70.0GW and its external sales volume will reach 33.9GW.

Industry analysts from New Horizon said that as a new material, monocrystalline silicon has excellent performance and is widely used in emerging strategic industries in countries such as photovoltaic and semiconductor. With the rapid development of downstream industries, the scale of China's monocrystalline silicon market will further expand. The production process of monocrystalline silicon is relatively complex. Benefiting from the continuous innovation of leading enterprises in production technology, China's monocrystalline silicon production capacity expanded rapidly and the output continued to grow. With the continuous acceleration of industrial structure layout, China's monocrystalline silicon industry will have broad prospects for development.